In 2022, over a thousand western companies exited Russia, standing in solidarity against its invasion of Ukraine, pressured by ethical issues, sanctions, and financial feasibility after key infrastructure, SWIFT, banned Russian banks from transacting. If peace talks succeed and these bans are lifted, western firms might be drawn back by Russia’s sizable market, especially as lifted sanctions could restore legal operational frameworks. However, they would face factors including competition from Chinese companies, which have expanded their presence, and reputational backlash for reversing their earlier principled exits. For instance, brands like Starbucks, which offloaded assets to local entities, may struggle to re-establish themselves given new regulations or consumer scepticism where reputation is a necessity to thrive in the coffee business. Each company’s choice will hinge on the peace agreement’s durability and Russia’s economic strategies.

Russia could see economic upsides from welcoming back Western firms, including inflows of capital, technology, and employment opportunities vital for rebuilding after conflict. This might also project an image of renewed global engagement, ease tensions with Western nations, and regain its standing in global hegemony if peace talks allow for diplomatic thaw. Yet, the government might prioritise local or allied businesses, consolidating a self-reliance push and past friction with the West. Having seized assets from some exiting firms, Russia’s leadership may adopt a guarded stance, wary of relinquishing control over strategic industries, although this might be tolerated by having frozen Russian asset returns to its rightful owner. Nationalist fervour and a focus on homegrown development could complicate its openness to foreign re-entry.

As of February 2025, US-Russia peace negotiations are ongoing, though Ukraine’s absence from the table casts doubt on the agreement’s scope and staying power, albeit its current vanguard can only continue with a perpetual fund from America. A successful outcome could reshape the business climate, easing sanctions and lowering risks for Western companies eyeing a return. Ukraine’s sidelined demands—such as troop pullouts and accountability for war crimes—may introduce variability into the talks’ trajectory, not to mention a suspicious operation held at Chernobyl's protective dome, which may have a false flag operation to sidetrack negotiations. Only time will tell whether President Trump will navigate the discourse successfully or not, bringing back over $107 billion in losses on foreign firms from the 2022 corporate pullout. Economic prospects, competitive shifts, and political currents will collectively influence what lies ahead for Western businesses in Russia.

Source: Reuters, NYT, Yale

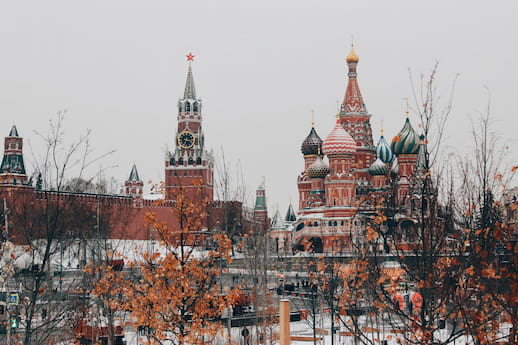

Photo: Unsplash